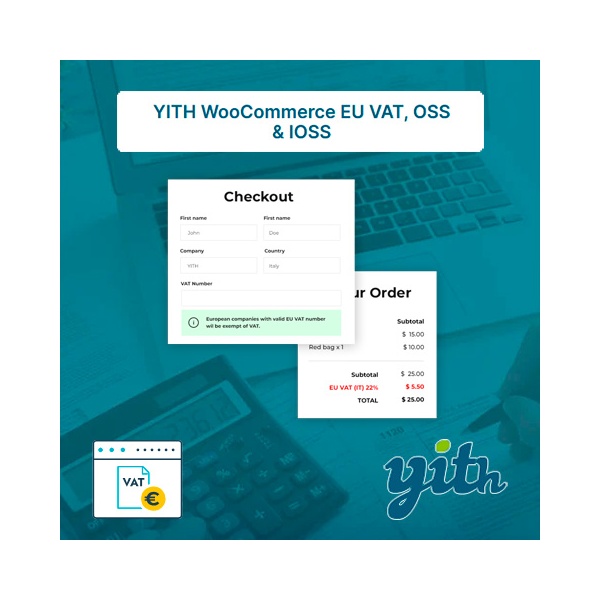

YITH WooCommerce EU VAT, OSS & IOSS Premium allows you to adapt your online store sales to the EU regulation that specifies that, for digital products, the VAT of the buyer's country of residence must be applied, and not the VAT of the country where the store is located, allowing you to automatically apply the correct taxes on each sale.

In addition, YITH WooCommerce EU VAT, OSS & IOSS Premium performs and stores the double check of the buyer's country of origin, as required by the European VAT law on digital downloads.

In case you don't want to have to deal with the VAT settlement at European level, YITH WooCommerce EU VAT, OSS & IOSS Premium can avoid purchases from European customers who are not located in the same country as the store.

Characteristics of YITH WooCommerce EU VAT, OSS & IOSS Premium

- You can avoid purchases from customers located in the European Union.

- Automatic creation of taxes for European countries

- Personalized messaging for community sales avoided

- Creates the MOSS report (Mini One-Stop Shop), allowing filtering by country and time period.

- Possibility of eliminating VAT if the customer supplies an EU VAT number registered in the VIES.

- You can retransmit purchases from EU customers only to those who have a valid VAT number.

- Requests additional information in case of discrepancy in the verification (i.e. the user declares to be in one country but is geolocated in another).

- You can select whether to show the field for the VAT number to buyers who are in the same country as you.

To download YITH WooCommerce EU VAT Premium from WPZone you will receive exactly the same .zip file you would get from YITH. Save up to 99% and 100% safe and virus free, as all files are verified by McAfee Secure.

It works great, thank you.